This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features COVID-19 crisis statistics and surveys about third-party delivery, guest expectations, QSR reliance and more.

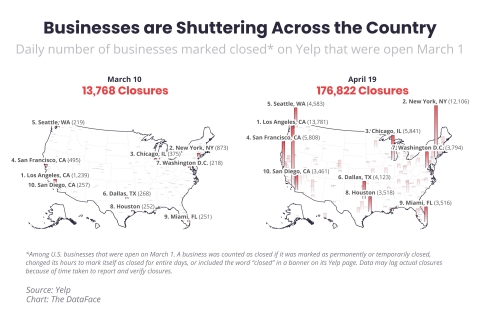

Yelp Economic Average

Q1 Yelp Economic Average (YEA), which takes a holistic look at the local economic changes since the start of 2020, focused on the economic impact of COVID-19.

Key restaurant findings from the Q1 2020 YEA include:

- More than 30,000 restaurants have shut down – temporarily or permanently – as of Sunday, April 19.

- Consumer interest in restaurants dropped by 52 percent from March 10 to April 19.

- Bars and nightlife businesses were among the hardest hit, with consumer interest down 81 percent.

Some businesses have had a harder time adapting their business models, including French restaurants (-62 percent in seasonally adjusted consumer interest relative to other similar types of businesses), tapas & small plates (-57 percent) and hot pot (-53 percent).

Other businesses have seen a surge of consumer interest, including chicken-wing joints (+84 percent), pizzerias (+71 percent) and fast-food restaurants (+55 percent).

Interest in Chinese restaurants declined in January from stigma and fear of the virus, but has increased (+63 percent) now that delivery and takeout reign.

Takeout and delivery increased 300X in a couple of weeks relative to reservations and wait list on Yelp.

Restaurant Industry Consumer Perspectives

Revenue Management Solutions (RMS) revealed insights from its global consumer study that assessed consumers’ dining behavior and perspectives on the restaurant industry as the COVID-19 pandemic unfolds.

The research was conducted in early April in five countries (U.S., U.K., Taiwan, Singapore and South Korea) with 1,897 respondents. RMS, which counts 100,000 restaurants in 40 countries as clients, sought to answer the question: How has consumers’ thinking about food and dining changed during the pandemic?

The answers are an entry point for understanding consumers’ needs as brands start to reopen, notes RMS CEO John Oakes.

Trust in restaurants remains high

When asked if they trust that the restaurant industry is able to safely produce and deliver meals, more than 75 percent of respondents in every country agreed.

“The industry’s successful recovery will depend on a customer’s feeling of well-being,” noted Oakes. “We have a long way to full recovery, but brands can take heart that we are starting from a place of trust and confidence.”

Frequent users adjusted their purchase behavior

U.S. frequent users who dined out five or more times per week pre-COVID (35 percent of respondents) indicated minimal decline in takeout and drive-thru. In Taiwan and South Korea, where restaurant dining rooms remained open during the pandemic, frequent users actually reported ordering more takeout and delivery. Singapore recognized a similar increase.

RMS Director Dr. Christina Norton noted: “Frequent users in the U.S. dine out more often to fulfill basic needs and gravitate toward drive-thru and take-away options associated with QSR and fast casual. In the U.K. and Asia, frequent users tend to be more pleasure-seeking and favor options such as meal kits as well as delivery and take-away from casual dining restaurants.”

Recovery predictions range by country

U.S. frequent users were also optimistic about return to normal. More than two-thirds — 67 percent — believe the restaurant industry will recover within six months, with 36 percent saying they expect that to happen within the next three months. The future didn’t look as bright to all respondents, however.

- In Asia, 73 percent of frequent users believe the industry will recover within 12 months, with 33 percent expecting a turnaround within six months.

- In the U.K., 79 percent of frequent users believe the industry will recover within 12 months, while 35 percent say within six months.

Deciding where to eat has changed

How consumers make dining decisions has changed substantially. Visible hygiene practices and minimal contact are now the top two factors that most influence consumers.

In Asia, the third factor most often cited was provenance and food production methods. In the U.S. and U.K., a brand’s reputation remains the top reason for choosing a restaurant, consistent with consumers’ expression of trust for the industry.

“We see a consumer mandate to implement visible hygiene practices and contactless service options for safe food delivery,” said Norton. “Brands have a real opportunity to reassure and bring back customers.”

Safety, hygiene and the food supply chain

Respondents across all countries said their top food-related concerns were: safety and hygiene, access to healthy foods, and nutrition.

- In the U.K., U.S. and Singapore, over 50 percent of all respondents in each usage group are concerned about variety and availability of foods in the coming months.

- In the U.S. and U.K., consumers are also concerned with how food will be produced, and over 50 percent show distrust in the food supply chain.

RMS’ survey is part of an ongoing effort to provide data and support to its clients in the restaurant industry now faced with the challenges of pandemic response. RMS’ online resource page includes weekly forecasts, impact reports, global restrictions currently in place, and expert advice on a number of profitable, practical recovery strategies that operators can implement immediately.

“We are committed to doing all we can to support restaurants,” said Oakes. “We are in daily conversations with our clients, constantly monitoring insights, and relying on our core business — analyzing data to deliver market insights — to serve the industry.”

Gauging Customer Reaction to Reopening

Fifth-generation restaurateur Philipp Sitter used his loyalty rewards platform VIPinsiders to gauge how customers will react to re-opening dining rooms and how they feel about ordering from restaurants during the pandemic.

In just 24 hours, more than 8,500 diners took his poll; questions ranged from "What type of Personal Protective Equipment (PPE) do you want restaurants to use after reopening?" to "When do you feel your normal dining routine will go back to normal?" Now, he's focused on translating these results to help other restaurateurs better understand how this will affect their bottom line.

"Trying to grasp what people are actually thinking is now the most important thing. We wanted to hear from REAL people," said Sitter. The results reflect a shocking number of expectations from diners including how much they are willing to spend and what type of restaurant marketing they will be receptive to moving forward.

"A restaurant's ability to market itself and earn its customer base back is more important than ever, and specifically, knowing how customers want to receive the offers is crucial. According to this survey, they no longer want emails and social media won't do the trick like it once did," said Sitter.

Sitter has made his data readily available for restaurant owners across the country and will continue to update the results. "As a restaurant owner, it's very challenging to efficiently pivot as quickly as we have all had to do these past few months with curbside and delivery. Now, we are in that same boat as we enter phase one in Texas," said Sitter.

*The participants in this survey came from friends, family, colleagues, restaurant clients' customers, social media sites, and foodie groups. Independent social media ads ran with the survey using interests targeted toward restaurants. A link to the official survey can be found here.

Consumer Fears and Workable Concepts

Sense360's research examined survey results on consumer fears of COVID-19, their expectations of when life will return to normal, and how different segments of the population are thinking and acting. Here are a few highlights:

- We've seen a gradual increase in unemployed and underemployed people but the rate of growth week on week has begun to slow, which hopefully implies there's a tapering off of the massive layoffs and furloughs we experienced early on.

- People's opinions are beginning to polarize in terms of when they think things will return to normal. There was an increase responses that things will normalize in the next two weeks, but also 6 months or longer.

- Suburban and rural consumers are much more likely to consider COVID-19 a smaller threat; urban consumers continue to see this as a bigger threat and growing every week.

There's been a slight decline in preparing meals at home; nearly a quarter of people were eating food from a restaurant or prepared by a retailer, which aligns with the slight improvements in traffic trends for restaurants in recent days. The shift towards fast food is coming from lower income consumers, while more affluent consumers are increasing consumption from full-service restaurants.

Sense360 also concept-tested several tactics that restaurants could implement to attract more customers, build bigger check sizes, and increase occasions for the post COVID-19 world. Here are a few highlights:

The top-rated concept that was most desirable to consumers was free delivery, where the restaurant covers both the delivery fee and the tip. The concept had a few caveats: consumers want the menu has to be the same as dine-in (not just a few menu items), food prices can't just be marked up to offset the costs, and they wouldn't want high order minimums.

The second highest-rated concept was businesses offering free face masks. But people would want the masks to be individually packaged in a sterile way, situated at the entrance and offered to all incoming customers, and handed out by an employee in some kind of controlled way – not a free grab-bag, if you will.

Third-Party Delivery Impact

Service Management Group (SMG) introduced its third annual report on third-party delivery: Take control of third-party delivery to protect your brand. SMG has closely followed the rise of off-premise dining and the impact of COVID-19 on consumer behavior to help restaurants navigate customer experience challenges, protect brand reputation and drive customer loyalty.

Using BrandGeek®—SMG’s market intelligence tool and the fastest, most accurate source of behavioral data linked to customer feedback in real time—SMG launched the longitudinal third-party delivery study in late 2017 and has collected three waves of consumer feedback. Learning from more than 47,000 respondents, SMG has answered three key questions to help restaurant brands capitalize on third-party delivery:

What is the state of third-party delivery?

Third-party delivery awareness and usage continue to rise, though at a slower rate than the last two waves of this report. Prior to the pandemic, 80 percent of respondents were aware of third-party delivery and 43 percent reported using the service in the past three months. And third-party delivery isn’t just gaining more customers, it’s seeing more frequent repeat customers, with 25 percent of respondents using it more than they have in the past.

Providing fast and convenient food options is the name of the game, with casual, fast-casual and fast-food concepts making up 74 percent of third-party delivery orders in this study. As delivery service has become more ubiquitous, orders by restaurant type have shifted across the board, with casual and fast-food brands increasing year-over-year market share by 10 and 16 percent, respectively.

Is delivery causing restaurant cannibalization?

While intuition might suggest third-party delivery is cannibalizing restaurant business, this study reveals quite the opposite. For respondents who started using third-party delivery following the previous wave of this study, there was a five percent increase in restaurant visits. Convenience is king for these users, and when they do visit a restaurant, they are two times more likely to use the drive-thru than dine in or carry out.

When it comes to selecting which restaurant to order from on a third-party delivery app, consumers are primarily motivated by a craving for a specific type of food or low delivery cost, but previous positive experience is also a key driver. What is more, three out of four consumers reported that if a restaurant isn’t available via third-party delivery, they will either get food elsewhere or skip the meal.

What are the biggest risks and opportunities?

Problem occurrence has continued to rise since the inception of the study, and it’s increased by 22 percent since 2017, with 42 percent of respondents reporting they’ve experienced a problem with a third-party delivery order. Although the transaction is processed by the delivery provider, 35 percent of customers place the blame solely on the restaurant when issues arise, and more than 60 percent of consumers believe the restaurant is at least partially responsible.

When a problem is reported, accuracy is cited 40 percent of the time (two times more frequently than the second most common problem type) and represents the greatest opportunity for restaurants to reduce problem occurrence.

“When you combine the impact of the coronavirus with the widespread awareness and increasing adoption of third-party delivery, restaurant brands can’t afford to overlook this growing channel,” said SMG President Michele Vance. “Delivery sales are projected to outpace on-premise revenue for the near future, and third-party delivery owns a big chunk of the market.”

To learn more about third-party delivery and review the seven food delivery trends uncovered in this study, download the report: Take control of third-party delivery to protect your brand or watch the on-demand webinar.

Eating 2020

Inspire PR Group and Illuminology released the results of a nationwide survey, Eating 2020: How COVID-19 Will Change Consumer Engagement With Food, which gauged more than 1,800 U.S. consumers’ food purchasing trends before, during and after the COVID-19 stay-at-home restrictions.

Health and Safety is Top Consumer Concern

Key results indicate that health and safety will remain a top concern for consumers once stay-at-home restrictions are lifted. The vast majority of those surveyed want restaurants to have employees wear face masks and encourage social distancing. However, when presented with all safety options, diners are most concerned about the perceived health threat posed by other customers, more so than employees.

“These findings contribute data to what we’ve believed to be true, that restaurants should prepare to meet consumer expectations for health and safety for some time to come,” said Hinda Mitchell, president of Inspire PR Group. “Clearly defined protocols around how these businesses will keep their customers safe – mostly from other customers – will be critical to restoring trust and confidence.”

Dine-In to Return (but Slowly)

Consumers who dined in at restaurants before the pandemic are likely to return when restaurant-specific orders lift – and that’s good news for U.S. restaurants. However, projections suggest that there could be a 20 percent difference in dine-in traffic over pre-COVID-19 levels. Also, restaurants that focus more on quality dine-in experiences (e.g. upscale restaurants, local/neighborhood restaurants, and fast casual restaurants) are more likely to return to pre-COVID-19 levels.

The research was conducted April 17-20, 2020, and surveyed 1,300 U.S. consumers and an additional sample of 500 Ohio consumers. The survey asked respondents about their restaurant and grocery behaviors in the first two months of 2020 before COVID-19 became a crisis in the U.S., behaviors during stay-at-home orders in April, and how consumers anticipate their behaviors will change in the first 60 days following when orders are lifted.

“Overall, these data tell a story of consumers’ changing purchase patterns before, during, and after an incredible shock to our economic and health systems,” said Orie Kristel, CEO of Illuminology. “Groceries and restaurants need to be especially cautious when planning their operations after COVID-19 stay-at-home restrictions are lifted. Although many customers likely crave a great dining or shopping experience, many customers are also concerned about potential monetary or health issues.”

Additional insights from the U.S. survey of 1,300 respondents revealed:

Restaurant Behavior Insights

Thirty-seven percent of diners are extremely or very worried about getting sick from other customers if they eat a meal inside a restaurant.

While carryout, drive-thru and food delivery nearly doubled from once every two weeks to once per week, frequency of these services is projected to decrease significantly after stay-at-home restrictions are lifted.

All restaurant sectors, with the exception of fast food/QSR, saw dramatic decreases during COVID-19 restrictions, however most sectors are projected to see a return to pre-COVID-19 levels of visits.

Restaurant spending is a concern, with more than 60 percent feeling they could not pay or would worry about paying $75 for a family dinner out, suggesting the pandemic’s economic toll is a continued impact on the sector.

After COVID-19 restrictions lift, dine-in visits to restaurants will increase but not to pre-stay-at-home levels (45 percent of people will dine inside a restaurant soon after COVID-19 restrictions are lifted vs. 67 percent pre-COVID-19 restrictions).

Grocery Store Behaviors Will Change

Although grocery chains saw a surge of new customers for online pickup and delivery orders in April 2020, these platforms are likely to see significant declines back to pre-COVID-19 levels or lower after stay-at-home restrictions are lifted. The survey found that of the recently acquired shoppers, more than one-third are unlikely to use online pickup and nearly half are unlikely to use online delivery when restrictions are lifted.

Stockpiling extra nonperishable foods and household supplies is likely to continue, with four in 10 respondents saying they’re very likely to buy and store these items after stay-at-home restrictions are lifted.

Consumers are fearful of other shoppers making them ill. Approximately 23 percent of shoppers most prefer that customers wear face masks and 18 percent prefer that the number of customers in the store be limited.

When the shelter-in-place restrictions are lifted, in-store visits will increase, but online shopping will decrease or remain flat.

Consumer Behaviors from One of the Early States to Issue a Stay-at-Home Order

The research also sampled 500 respondents in Ohio, which was among the first wave of states to adopt the stay-at-home measures and has seen “flattening” of the case curve. Under the leadership of Governor Mike DeWine, Ohio has been notably aggressive in its response to COVID-19, and the state mounted a broad public information campaign to educate residents.

Although the consumer behaviors between the Ohio and national research draw many similarities, one significant finding is that Ohioans are statistically less likely to be extremely or very worried about getting sick from COVID-19 compared to the nation as a whole, 33 percent vs. 41 percent, respectively.

The full report and methodology can be downloaded at InspirePRGroup.com.

Rely on QSR

Digital Experience Consultancy, Bottle Rocket, has released a Quick Service Restaurant (QSR) research study following the outbreak of COVID-19. This reveals that despite a shift towards home meal preparation, over a third of customers will rely heavily on QSRs in the coming weeks.

Leveraging Alpha, Bottle Rocket asked 500+ customers questions across 50 states, about how their needs were being met by their favorite restaurants, how they prefer to receive information, and what restaurants could do to win more business.

“We monitored how people are interacting with QSRs during this COVID-19 timeframe. Changes in shopping behavior and purchase decisions are separating consumers into two camps: 1) those who are less reliant on takeout and QSRs and 2) those who intend to continue to order a majority of food from QSRs. It is critical that QSRs engage with each segment differently and recalibrate their business decisions and marketing communication strategies – and fast,” said Rajesh Midha, Chief Strategy Officer of Bottle Rocket.

Rajesh continues: “Due to the shifting changes in consumer behavior driven by COVID-19, we would encourage brands to bring information to their customers on their owned channels to drive engagement and conversion rates. In order to remain afloat now and to bounce back once the worst has passed, firms need to utilize their customer data in real time now and understand how their customers want to receive information. These firms should also intensify their efforts to ensure the best customer experience is delivered.”

Key highlights from the survey include:

- Nearly 20 percent of respondents claimed that they would not return to a QSR or fast-food restaurant in the next week.

- Respondents in the 40 to 44-year-old cohort are 30 percent more likely to prefer finding news on a restaurant’s app over checking the same restaurant’s website.

- 80 percent of customers are more likely to order from a restaurant if they offer rewards for digital or text message ordering.

Focus on Recovery

New Nielsen CGA data spotlights the earliest stages of recovery for the U.S. on-premise channel specifically.

After the last few weeks of week-on-week sales velocity increases, the market has begun to flatten out (from -75 percent vs. pre-COVID norms at the start of April to -68 percent for the week ending April 25).

Overall, the on-premise trade has shown it has started to adapt to current market conditions. For those U.S. establishments still operating, dollar sales velocity is +42 percent for the week ending April 25 vs. the week ending March 28. And the average number of checks at Nielsen CGA measured outlets is +69 percent for the week ending April 25 vs. week ending March 28.

Increasing from nine percent in the two weeks ending April 11, 14 percent of U.S. consumers have ordered a take out/delivery that included alcohol. The number also increased for 21-34 year olds, from 18 percent to 28 percent having ordered a take out/delivery with alcoholic drinks.

When asking consumers when they plan to return to bars and restaurants after shelter-in-place restrictions are lifted, the greatest percentages responded that they will return when venues demonstrate they can facilitate social distancing (28 percent) and once the number of COVID-19 cases doesn’t start to increase again (23 percent). This is followed by 22 percent that will return as soon as outlets reopen.

Twenty-seven percent of consumers are now stating that they are drinking more whilst in lockdown as opposed to 22 percent who are saying they are drinking less.

The top things consumers want to see in venues when they reopen:

- having fewer tables or patrons within venues to accommodate social distancing (50 percent),

- additional hygiene programs taking place in outlets (49 percent)

- take out/ delivery offerings still being available (41 percent)

- Even in the current climate, full of worry and uncertainty, half of consumers said they plan to eat (53 percent) and drink (50 percent) out the same or more often than pre-COVID-19, showing that a strong proportion assume they will return to their normal on-premise habits once it reopens.

Changing Restaurant Purchases

Some governments are letting businesses reopen, but customers aren't likely to return in strength, according to findings from a survey of 1,000 consumers across the US. Conducted by Market Research Answers, Inc., the survey queried respondents about their restaurant purchases pre- and post-COVID-19 outbreak, and asked them about their confidence in restaurant safety and their expected future purchases from restaurants. Key findings:

- Though many restaurants provided takeout or delivery after dining rooms were closed, order-out purchases by respondents declined pre- to post-outbreak, and the share of respondents never order-out rose sharply

- Seventy-five percent of respondents say they are cooking more at home, and 25 percent expressed concern about takeout and delivery safety

- Along with more in-home food prep and safety worries, restaurant purchases were also impacted by pocketbook concerns since 43 percent of survey respondents said they expect their 2020 household incomes to be lower than 2019

- Half of respondents expressed concern over restaurant operators' ability to ensure staff and customer safety when they reopen dining rooms

- Forty-three percent of survey respondents expect purchases from restaurants going forward to be less than they were prior to the COVID-19 outbreak.

"The restaurant business is resilient and filled with resourceful operators who will find opportunities to improve their practices and provide new offerings," said MRA president Harold Gross. "But many consumers are apprehensive about being in places where they're going to have contact with staff and other customers. Add paycheck worries to that, and it suggests that recovery for restaurants will proceed slowly and tentatively, with a lot of hiccups. We also expect budget-constrained consumers will want lower price-point options."

He added that there are also implications for the broader economy. "It's a big industry, accounting 10 percent of total nonagricultural employment in the US, so what we see unfolding for restaurants offers some perspective on how quickly the broader economy will turnaround."

"There's been a lot of speculation about whether a recovery looks like a 'V' or a 'U'. We think it's going to look like a flattened sine-wave, oscillating up and down as secondary and tertiary impacts ripple through. If a sizeable share of consumers is concerned about their safety or whether they should be spending their money on a discretionary purchase, it isn't just restaurants that will be affected," said Gross.

Foot Traffic Analysis

According to Placer.ai, in January and February, Chick-fil-A saw two months with over 20 percent year-over-year growth, while Chipotle was continuing its strong rebound with 14.6 percent and 24.5 percent visitor growth, respectively. Heavyweights like McDonald’s, Burger King and Taco Bell were also enjoying strong starts to the year.

Visits not only saw growth but incredibly high growth in the last week of February and the first week of March. The group analyzed averaged a 10 percent increase in visits during the second week of March year-over-year with Chick-fil-A leading the way with a jump of over 18 percent.

Chick-fil-A saw the two Saturdays prior to shutting dining rooms come in as the highest traffic days the company had seen nationwide since the start of 2019. Even more, when the decision to close dine-in came, the blow was felt swiftly. Visits went from 24.1 percent above the baseline on Saturday the 14th to 37.7 percent below on Monday the 16th. From here, visits found a bottom that has continued through early April.

Placer.ai believes the likeliest explanation for the high peak prior to shutdowns nationwide is that people turned to QSR either for fear it would be harder to get or for comfort in a crazy period. Even with the significant decline, McDonald’s was still able to eke out positive same-store numbers in March according to recently announced earnings.

The lingering desire for fast food alongside a future economic situation that emphasizes the value orientation of their offering positions the sector to rebound quickly. Additionally, the existence of some of its revenue channels – including delivery and drive-thru – should limit the ultimate impact.

Placer.ai found the Fast Food brands analyzed visits held strong for an exceptionally long period considering the wider COVID-19 concerns. They conclude there are many reasons to believe that once restrictions are lifted, the wider space will be among those best-positioned to succeed.

Health and Safety of Restaurants

Forty-seven percent of consumers trust restaurants and bars to take the necessary steps to ensure their health and safety in the future, trailing only museums among the travel, hospitality and leisure category.

That’s according to a new study from research consultancy Magid.

Despite this higher level of trust, consumers will be hesitant to return to these establishments in the near-term, as only 31 percent plan to dine-in at a restaurant within the next three months and 57 percent within the next six months.

Consumers would consider visiting restaurants sooner if automatic doors were installed (64 percent), personal sanitation kits were provided at each table (56 percent) or visible hand-washing stations for employees were installed (55 percent) to put consumer’s minds at ease.

Other findings from the research include:

- Sixty-three percent of consumers are concerned that the coronavirus will cause their favorite restaurant to close. 60 percent feel that the government should provide assistance to help restaurants recover

- Forty-one percent will avoid exchanging cash when dining at restaurants, bars or cafes

- Thirty-nine percent will avoid ordering beverages that are not served in the original can or bottle

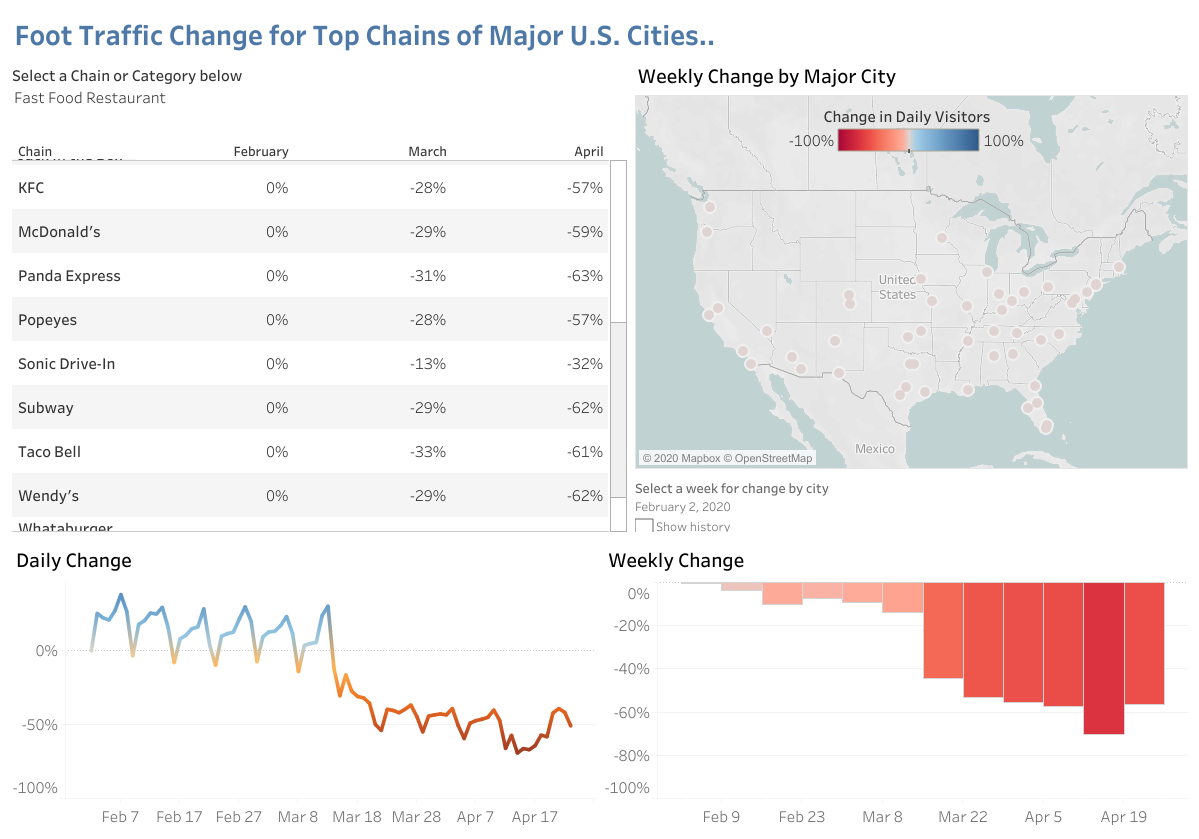

Foot Traffic Dashboard

Location intelligence company Gravy Analytics has created an interactive dashboard visualizing consumer foot traffic changes at 200 leading brands across 50 major cities since February.

Updated weekly, this dashboard will be an especially valuable resource in tracking consumer behavior as state governments begin lifting stay-at-home orders. As an example of the insights the dashboard can give you, here’s a look at foot traffic to some major fast food chains over the last three months.

Hourly Workers in COVID-19 Crisis

Bluecrew, the staffing technology platform connecting job seekers with W-2 protected hourly work, today released new survey results which indicate hourly workers are bearing the brunt of unemployment and uncertainty in the face of the COVID-19-fueled recession. The survey found hourly workers are filing for unemployment in greater numbers, face challenges in accessing government assistance, and are more concerned about their ability to make ends meet as compared to salaried workers. Safety is also top of mind with more than a third of the hourly workers surveyed worried about being exposed to COVID-19 while on the job. The survey of 1,650 Americans was conducted this month.

According to the data, 42 percent of hourly workers have already filed or plan to file for unemployment benefits, compared to just 17 percent of salaried workers. Over half (57 percent) are concerned they won’t be able to find a new job if they have lost or may lose their job. Seventy-eight percent are worried they won’t be able to make ends meet during the pandemic, likely due to the fact that nearly half of hourly workers (47 percent) have less than $1,000 in savings.

The report also reveals hourly worker confusion over the CARES Act which provides workers who have been laid off or have reduced hours with extended unemployment benefits including an additional $600 a week. Nearly half (47 percent) say they are aware of the CARES Act but don’t know if they qualify or have no idea what it is. Further, 46 percent fear that overloaded government systems will prevent them from accessing unemployment benefits or other government assistance.

Among those still working, safety on the job is another concern: 51 percent report their employers are not offering any additional relief or benefits amid the pandemic. The majority (54 percent) are worried about being exposed to COVID-19, and 18 percent are considering quitting their job due to it.

“This survey puts actual numbers to stories we hear and see every day, and underscores the painful reality for millions of hourly and shift workers who are performing essential tasks — like stocking shelves, delivering groceries, and making sure factories and warehouses can transport products to millions of consumers sheltering at home,” said Gino Rooney, Bluecrew co-founder and CTO. “These workers need better access to health and financial assistance, as well as protections and workplace policies that put safety first. At Bluecrew, we’re committed to doing our part to support and protect hourly workers through these unprecedented times — we recently rolled out extended sick leave for those Crew Members impacted by COVID-19 along with telemedicine options.”

Additional highlights among the respondents collectively include:

- More than a third (38 percent) believe it will take the job market 11 months or longer to recover once the immediate danger of COVID-19 passes.

- The majority (70 percent) are worried about making ends meet during the pandemic and 40 percent have less than $1,000 in savings.

- Americans are most anxious about health and safety amid COVID-19 followed closely by how they’re going to pay for basic living expenses and a slow recovery that makes it difficult to get hired or keep a job.

Nearly a third (30 percent) have had to file or plan to file for unemployment and 40 percent are concerned they won’t be able to access unemployment or government assistance due to technical glitches or confusing processes.

Check out the e-book for additional details.

Events and COVID-19

Tripleseat conducted a survey to gather insights from event professionals on how they are handling the upcoming year of business. Below are some of their top findings:

Ninety-six percent of event planners that responded to the survey said they have rescheduled an event originally planned for the spring or summer of 2020. In the short term, respondents to the survey said they have implemented online solutions to replace live events, such as webinars, virtual events and happy hours.

Most planners are moving events to late summer or beyond; the top three time frames are:

- September (29 percent)

- January 2021 or after (24 percent)

- August (16 percent)

As planners start to work on their future events, they’re looking for specific information and practices from restaurants and venues. This includes:

- Booking and cancellation policies, 74.7 percent

- Cleaning and safety protocols, 53.7 percent

- Specials and incentives for booking events, 36.8 percent

- Video conferencing capabilities, 36.8 percent

- Venue availability, 41.1 percent

- Deadlines for event setups, equipment needs, meal counts, etc. 15.8 percent

Kiosk Safety

New research by mobile order and pay provider Wi5 shows that nearly two thirds of UK adults (61 percent) say they will avoid using touch-screen kiosks to order food and drink in hospitality venues once the lockdown measures are lifted. Touch-screen kiosks have become hugely popular in fast-food outlets such as McDonald’s and Burger King in recent years, but fears over sharing the screens with other customers is now likely to hugely impact their usage.

Instead, 59 percent of respondents to the survey agreed they would now be more likely “to use my own mobile to order and pay from a table” than before the crisis took hold. Of those who said they’d avoid using a touch-screen, the number one reason was “not liking the thought of touching a screen used by so many other people before touching my food”.

The research found that over half of respondents said they were likely to return to fast food (59 percent) and casual dining restaurants (51 percent), pubs and bars (51 percent) and cafés (58 percent) within weeks of venues reopening.

The findings provide hospitality operators with some clear guidance on what customers will be looking for in order to entice them back to venues reopening their doors. When asked what would make them more likely to visit a restaurant, bar or café after the lockdown, most want to know there are clear hygiene measures in place, with 58 percent saying they would want to know the venue is being regularly cleaned, and 54 percent wanting to see provision of hand-sanitiser throughout the venue. The next most important issues relate to social distancing, with 48 percent wanting to see limits to the numbers of customers in each store, and 36 percent saying they would be swayed positively by seeing floor markers for social distancing.

Gavin Peters, Chief Marketing & Strategy Officer for Wi5 said “These results clearly show how customer behaviour in hospitality will change after the lockdown ends, with ordering kiosks likely to be seen as too much of a hygiene risk for most customers. Helping customers use their own devices for ordering, making some simple operational changes to limit any perceived unnecessary hygiene risks and, crucially, communicating those changes well to customers will be key to helping rebuild consumer confidence and ensuring the sector recovers as fast as possible”.

Coronavirus and Local Search

Uberall, Inc., released a new report examining how the coronavirus pandemic is changing local search across the globe. Uberall looked at more than 650,000 business locations and Google My Business profiles in multiple countries — the US, Germany, France, Italy, and the UK — between mid-January and mid-March. The findings offer a snapshot of how the coronavirus is impacting consumer buying and local search as behavior evolves in response to the crisis.

Local impressions only down 10 percent

Given the restriction of offline movement and decline of economic activity, it would be natural to assume that local search has dramatically fallen or even evaporated. However, Uberall's data shows that local search impressions since early February have remained fairly stable — off only about 10 percent.

“Digital presence management for multi-location brands and single-location businesses has arguably become even more critical now,” said Greg Sterling, VP of Insights, Uberall. “As footfall has declined for most local retailers and other merchants, online visits and calls have grown. Out of necessity, consumers have further embraced the internet as a tool for information about the physical world around them.”

Website visits for the travel industry have cratered

During the COVID-19 pandemic, the travel industry in particular has seen a significant drop in business. Uberall’s research found that airline and airport website visits from local searches are down 47 percent, while hotel site visits are down 42 percent. With people being told to stay home, the majority of travel is being paused or canceled. In line with less air travel and fewer hotel bookings, tourism services are also down 26 percent.

“For obvious reasons, travel and hospitality are among the hardest hit segments,” said Sterling. “Consumer actions and engagement with travel properties are down across the board. This will continue until the pandemic subsides and other confidence-building measures, such as widespread testing, are in place.”

Some businesses are booming

While the travel industry is taking a substantial hit from COVID-19, other industries are actually seeing an increase. Uberall found that site visits for local grocery stores are up 118 percent, while site visits for businesses in the health/medical category are up 147 percent.

“Grocery and medical site traffic won’t be declining anytime soon,” said Sterling. “If anything, these numbers will continue to grow as the need for these businesses remains or increases.”

Directions for certain retailers are way down

Today, most people are only leaving their homes if it’s absolutely necessary. So it’s unsurprising that driving directions to local apparel retailers are down 58 percent. On the other hand, in March directions for health/medicine locations were way up. In fact, Uberall’s data found that they’ve seen a whopping 304 percent increase.

Food is driving the most phone calls

In the COVID-19 era, a significant percentage of local business phone calls revolve around food. Calls to restaurants with takeout have increased by 100 percent, while grocery stores have seen calls explode by 94 percent.

“In mid-March people switched from calling restaurants for reservations to ordering takeout or delivery,” said Sterling. “The uptick in calls to grocery stores is attributable to people seeking more information about delivery options, hours, or availability.”

For Uberall’s full “Coronavirus Effect” report, click here.

This article was originally published in ModernRestaurantManagement.com